Just like the Obama-Biden Administration, the Biden-Harris Administration has been sued for wielding the Internal Revenue Service (IRS) to unfairly target conservative organizations.

In 2013, as a result of a lawsuit by conservative nonprofits, the Obama-Biden Administration’s IRS admitted that it applied extra scrutiny to conservative groups in order to deny their requests for tax-exempt status.

Likewise, on August 29 of this year, the National Religious Broadcasters (NRB) association joined with two churches and a prayer ministry to file a lawsuit against Pres. Biden’s IRS for targeting conservative organizations and religious groups.

The complaint filed by NRB, First Baptist Church Waskom (Waskom, Texas), Intercessors for America (Purcellville, Va.), and Sand Springs Church (Athens, Texas) says that the Biden-Harris IRS is punishing conservative religious groups for comments explaining to their flocks how well an individual candidate’s policies do – or don’t – comport with Bible teachings.

Meanwhile, Biden’s IRS is refusing to penalize liberal groups and churches for speaking out in endorsement and praise of liberal politicians, a NRB press release announcing the lawsuit says, noting the IRS’s “arbitrary and capricious” enforcement of the Johnson Amendment, which the lawsuit is asking the court to declare unconstitutional:

“The complaint details the fact that many 501(c)(3) organizations engage in electoral activities that are open, obvious, and well-known, yet the IRS allows some, but not all, such organizations to do so without penalty.

“At this time, the IRS has no apparent rational basis for determining which 501(c)(3) organizations will be permitted to speak freely and which will be penalized for violating the Johnson Amendment; it acts in an arbitrary and capricious manner vis-à-vis electoral statements by nonprofit organizations.

“Moreover, the complaint argues that the IRS operates in a manner that disfavors conservative organizations and conservative, religious organizations in its enforcement of § 501(c)(3), constituting a denial of both religious freedom and equal protection.”

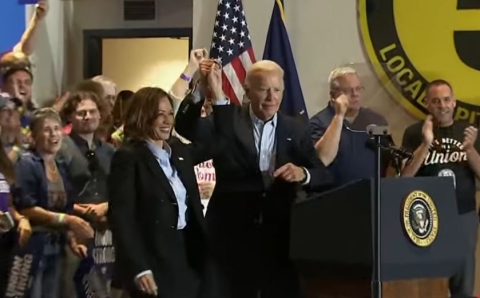

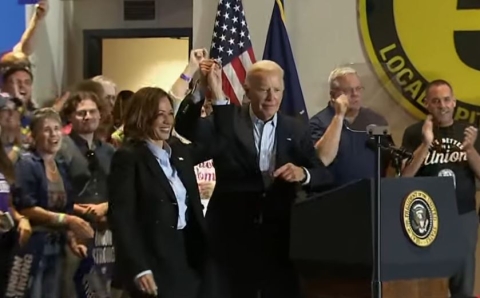

The lawsuit provides examples of Christian groups and churches being fined and denied tax-exempt status for comparing politicians’ policies to Bible teachings – and of the IRS failing to penalize liberal nonprofit media organizations and church leaders endorsing and praising Democrats, such as Pres. Biden and Vice Pres. Kamala Harris.

“Plaintiffs believe that the (liberals’) activity described … demonstrates ongoing, open, and obvious violations of the [law] by churches friendly to Democrat candidates,” the lawsuit states:

“To Plaintiffs’ knowledge, no investigation, and particularly no adverse action, has ever been taken against any left-leaning or Democrat-affiliated nonprofit.”

….

“The proportion of adverse actions taken against 501(c)(3) nonprofits skews disproportionately against conservative organizations.”

Conversely, on May 4, 2017, then-President Donald Trump signed an executive order “Promoting Free Speech and Religious Liberty” (E.O. 13798) directing his administration’s Treasury Department to ensure that the IRS “does not take any adverse action against any individual, house of worship, or other religious organization on the basis that such individual or organization speaks or has spoken about moral or political issues from a religious perspective.”

While Trump’s executive order did not attempt to revoke the Johnson Amendment (which would require an act of Congress), it did instruct the IRS to practice leniency in its application and enforcement in order to allow the greatest freedom of speech possible, within the boundaries of the law, to the religious community.

Also, under the Trump Administration, the Justice Department settled lawsuits by the Tea Party and other conservative nonprofits relating to the Biden-Harris IRS’s 2013 admission that it sought to deny tax-exempt status to conservative groups “based solely on their viewpoint or ideology.”

The IRS had singled out groups with names including terms like “Tea Party” or “Patriots,” and those with specific policy positions concerning government spending, in order to subject them to egregiously unreasonable criteria for obtaining tax-exempt status.

As part of the 2017 settlements, the IRS issued formal apologies and plaintiffs received monetary compensation.